The San Francisco Gross Receipts Tax is a local business tax approved by San Francisco voters in 2012 and most recently updated when Proposition F was approved by voters in 2020. This page provides an overview of the Gross Receipts Tax and demonstrates how it is applied to hypothetical businesses.

Calculating the Tax becomes more complex when a business has gross receipts from both inside and outside of San Francisco.

Businesses with gross receipts within and outside of San Francisco determine their San Francisco gross receipts generally using one or both of allocation and/or apportionment, as dictated by their business activities. Some business activities use only allocation (e.g., Real Estate and Rental and Leasing Services); some business activities use only apportionment (e.g., Financial Services); and some business activities use 50% allocation and 50% apportionment (e.g., Retail Trade). View business scenarios to see how this works.

Gross receipts generally are allocated to San Francisco if the property sold is shipped or delivered to a purchaser in San Francisco, if the benefit of the services generating the gross receipts is received in San Francisco, if the intangible property generating the gross receipts is used in the City, or if the property generating the gross receipts is located in San Francisco.

Gross receipts generally are apportioned to San Francisco by multiplying total gross receipts by the portion of the business's total payroll in San Francisco divided by the business’s total payroll.

View the video to understand how the Gross Receipts Tax is calculated for various types of businesses. Scroll down to review the Gross Receipts Tax calculations for hypothetical businesses outlined in the video.

Consider a restaurant operating solely in San Francisco with all its gross receipts from business within the City. All gross receipts will be counted when calculating the Gross Receipts Tax.

Business activity: Food Services

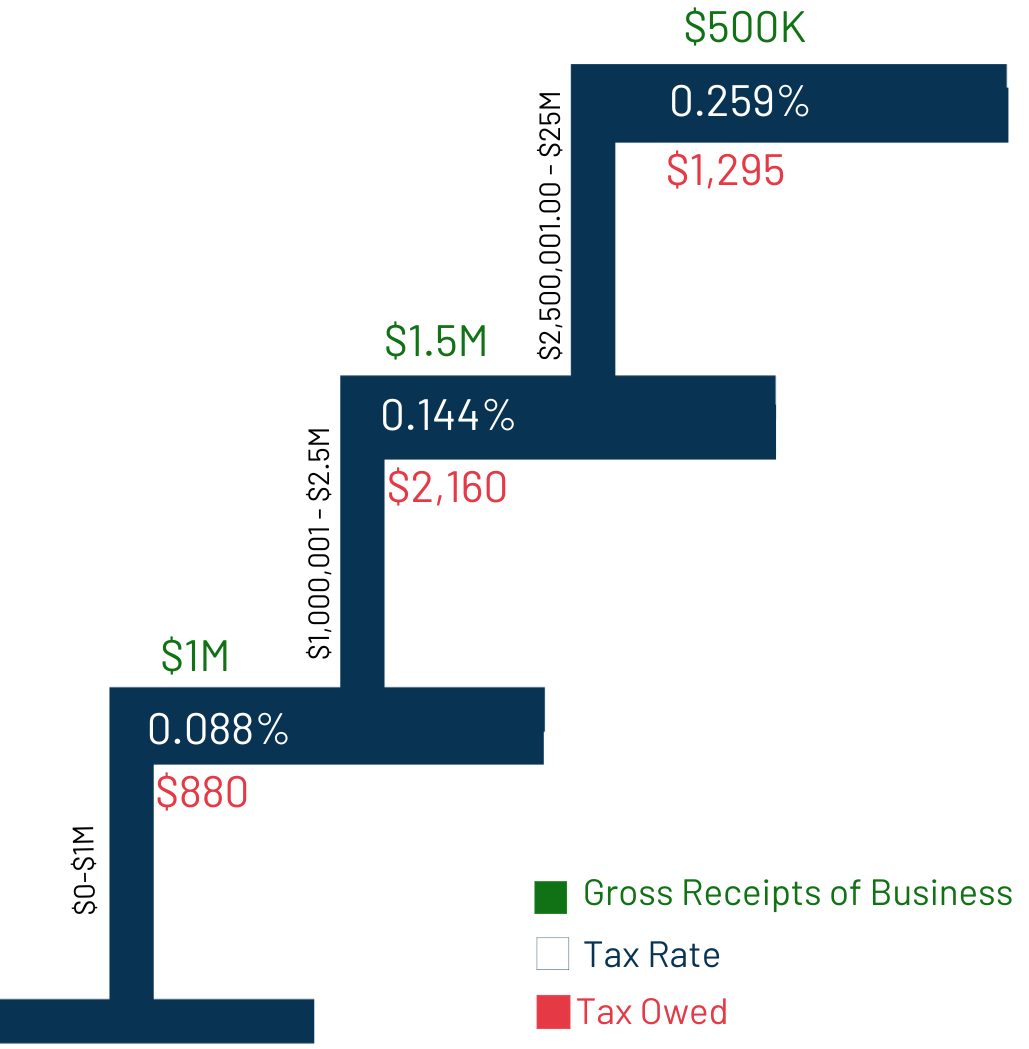

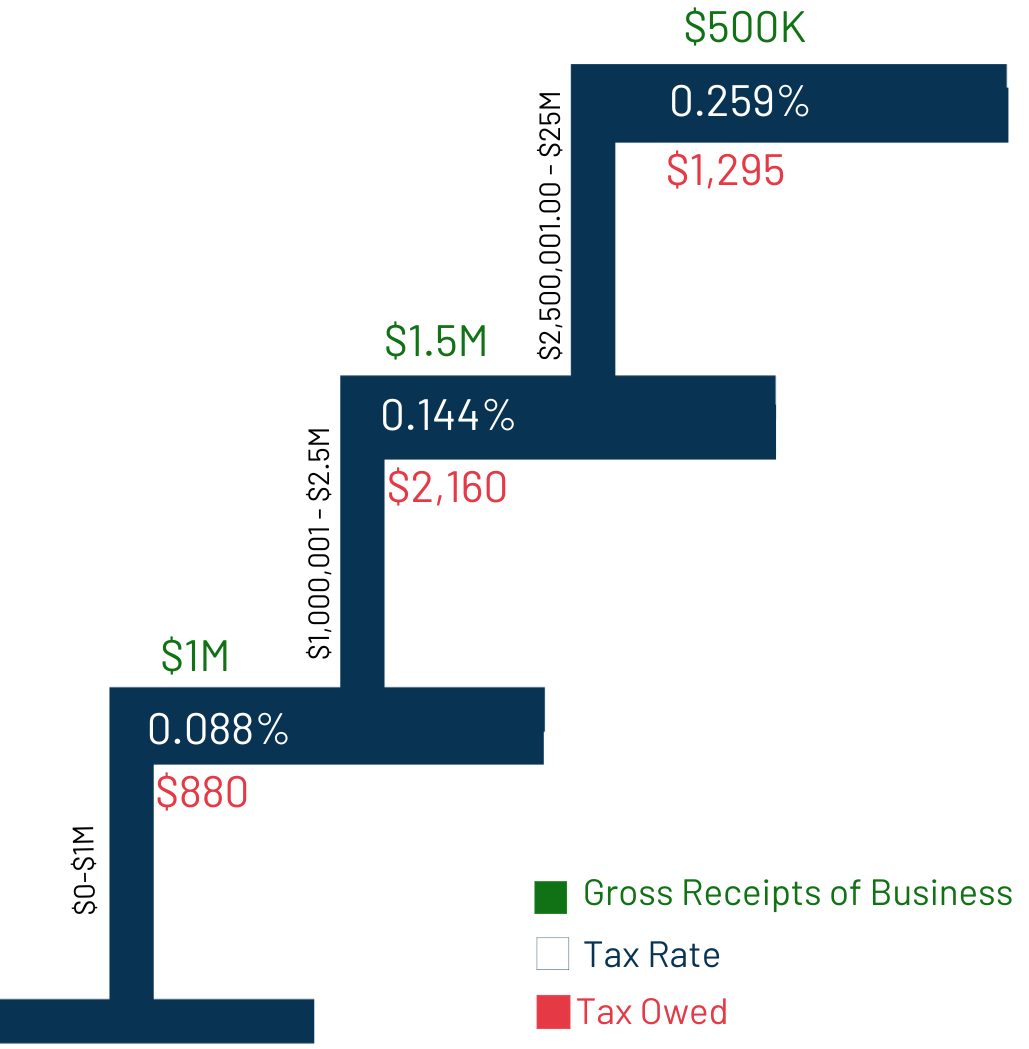

Apply the appropriate tax rates to the $3 million in San Francisco gross receipts and the resulting amount represents the Gross Receipts Tax owed by the business.

2022 Tax Rate (Food Services)

Gross Receipts of Business

Total

$3 million

$4,335

The tax has a progressive structure, as demonstrated below using the data from the left table. Each step of the stairs has a different tax rate. A portion of receipts are left on each step and taxed at that tax bracket’s rate. If the receipts exceed the threshold of that step, the remaining amount will progress to the next step and be taxed at the next highest rate.

Consider two businesses that have the same overall gross receipts and payroll numbers; a financial advisor and a clothing retailer. Also assume that the clothing retailer has sales allocated to San Francisco. The financial advisor will owe more than the clothing retailer because of policy choices made by City leaders and voters. For example, retail businesses have higher fixed costs like property and labor, so they have a lower tax rate than financial services businesses. And each has a different method for calculating their San Francisco gross receipts.

Business Activity: Financial Services

Calculate the San Francisco gross receipts:

For Financial Services, San Francisco gross receipts are determined 100% based on apportionment:

Apply the appropriate tax rates to the $3 million in San Francisco gross receipts and the resulting amount represents the Gross Receipts Tax owed by the business.

2022 Tax Rate (Financial Services)

Gross Receipts of Business

Total

$3 million

$20,175

Business Activity: Retail Trade

For Retail Trade, San Francisco gross receipts are determined 50% based on apportionment and 50% based on allocation:

Apply the appropriate tax rates to the $4 million in San Francisco gross receipts and the resulting amount represents the Gross Receipts Tax owed by the business.

2022 Tax Rate

(Retail Trade)

Gross Receipts of Business

Total

$4 million

$3,005

Gross Receipts Tax rates vary depending on a business' gross receipts and business activity. The tax is progressive, which is demonstrated in the restaurant example above.

Businesses with gross receipts from business activities both within and outside San Francisco must generally allocate and/or apportion gross receipts. This table indicates the applicable apportionment and/or allocation methodology for each business activity.

Business Activity

Calculation Method

Retail Trade; Wholesale Trade; and Certain Services

Manufacturing; Transportation and Warehousing; Information; Bio-Technology; Clean Technology; and Food Services

This section is 50% allocation and 50% based on payroll apportionment (Section 953.2(g))

Accommodations; Utilities; and Arts Entertainment and Recreation

Private Education and Health Services; Administrative and Support Services; and Miscellaneous Business Activities

This section is based on payroll apportionment (Section 953.4(d))

This Section is 50% allocation and 50% based on payroll apportionment (Section 953.5(c))

San Francisco gross receipts may be reduced by amounts paid in the tax year to a subcontractor possessing a valid business registration certificate with the City to the extent those amounts were included in the amount your business allocated to the City under Section 956.1. Persons must submit itemized deduction list in order to claim. (Section 953.5(c))

Financial Services; Insurance; and Professional, Scientific and Technical Services

This section is based on payroll apportionment (Section 953.6(e))

Real Estate and Rental and Leasing Services

This section is receipts derived from or related to properties located or used in the City. (Section 953.7 (c))

San Francisco's business tax structure is facing new challenges and is in need of reform. Mayor Breed and Board President Peskin asked the Treasurer, Controller, and Chief Economist to review the City's current business tax structure and develop recommendations for needed reforms. Learn more at the project's website.

| Business Activity | $1-2.5M | $2.5-$25M | $25M+ | |

| Accommodations / Arts etc. | 225 | 46 | 113 | 30 |

| Administrative and Support Services | 150 | 46 | 74 | 21 |

| Biotechnology / Clean Technology / Not Listed | 555 | 99 | 148 | 11 |

| Construction | 428 | 296 | 428 | 40 |

| Financial Services / Insurance | 278 | 154 | 382 | 131 |

| Food Services / Certain Services | 479 | 366 | 460 | 10 |

| Information | 240 | 121 | 281 | 109 |

| Manufacturing | 96 | 51 | 99 | 14 |

| Private Education and Health Services | 136 | 82 | 168 | 13 |

| Professional, Scientific, and Technical Services | 842 | 471 | 819 | 151 |

| Real Estate and Rental and Leasing Services | 567 | 214 | 399 | 82 |

| Retail Trade | 390 | 227 | 551 | 92 |

| Transportation and Warehousing / Utilities | 59 | 31 | 54 | 15 |

| Wholesale Trade | 164 | 96 | 249 | 60 |

San Francisco levied a 1.5% tax on the payroll expense of larger businesses in the city. San Francisco was the only city in California to base its business tax on payroll expense. Under the old system, businesses with more than $250,000 in payroll expense paid a flat 1.5% rate, and business registration fee revenue was comparatively small.

Proposition E was approved by San Francisco voters on November 6, 2012. Voters approved a shift from the payroll expense tax to one based on gross receipts. The change was intended to promote economic growth, greater revenue stability, and better equity in the business tax system. The new gross receipts tax system introduced a progressive rate structure, and a larger, progressive business registration fee.

Proposition F was approved by San Francisco voters on November 2, 2020 and became effective January 1, 2021. Proposition F completed the City’s transition from a Payroll Expense Tax to a Gross Receipts Tax, a decision initially approved by the voters in 2012 (Proposition E). Proposition F fully repealed the Payroll Expense Tax and increased the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses.

Visit our Help Center to submit a question. Questions submitted before 7:00 pm will receive a response on the SAME DAY. Questions submitted after 7:00 pm will receive a response by the next business day.